Larry Fink is head of the world’s largest funds management business, BlackRock. In his 2022 Letter to CEOs, he says ‘stakeholder capitalism’ is the only way to sustainable prosperity, and ESG is how it is achieved. His letter aligns with the view that a company’s intangibles, ESG and performance act in unison.

ESG and its siblings – corporate sustainability, CSR, shared value, the triple bottom line etc. have been around for about 30 years. The family keeps bubbling along, arguing amongst itself as to which has the better name, and forgetting they are all basically the same.

In the end ESG is winning as the best name, because it is so neutral. It’s reaching orthodoxy, because of the investment dollars being pushed into it, and now because reporting standards (another family of like beings) are being unified, under the International Sustainability Standards Board.

Every now and then, these related families gets a burst of energy. An event that nudges thinking towards responsibility and governance. In the US – Enron and Deep Horizon. In Australia – James Hardie, the Banking Royal Commission and Juukan Gorge. In the UK – the Stern Review and News of the World drama. And everywhere, the DotCom boom, Climate Change, the GFC, and the Pandemic.

Every now and again, too, there is a statement of support from an authoritative source. When some argued that considering ESG issues was contrary to a company director’s duty to consider only the company’s shareholders, the legal firm Freshfields confirmed that directors must also consider future shareholders, and so cannot trash the company’s reputation for quick cash today. When strategy consulting firms suggested that corporate sustainability was a distraction, Michael Porter wrote a powerful article in the Harvard Business Review saying it must be embedded in strategic thinking.

The latest such event is Larry Fink’s 2022 Letter to CEOs. As you know, Larry sits on top of Blackrock’s $13 trillion pile of cash. His letter is a flag jammed at the top of that pile, saying it will only be used with ESG in mind. Larry’s letter is not a game changer, but rather announces that the world has changed. Or, as he refers to old views of subservient employees: “That world is gone.”

If you haven’t already read Larry’s Letter, I’d like to introduce it to you, connect it to a simple model of ESG that we’ve been using for 20 years, and ask you to have a look at both.

Larry’s Letter is all about what he calls stakeholder capitalism. It starts strongly:

Stakeholder capitalism is not about politics. It is not a social or ideological agenda. It is not “woke.” It is capitalism, driven by mutually beneficial relationships between you and the employees, customers, suppliers, and communities your company relies on to prosper. This is the power of capitalism.

These relationships are at the centre. Many have long thought that corporate sustainability or ESG is all about engaging transparently with stakeholders on the things that matter to them. He then goes on to say:

“Putting your company’s purpose at the foundation of your relationships with your stakeholders is critical to long-term success.”

That purpose matters to employees who want to connect with it; to customers who want to hear what you stand for; and shareholders who need to understand your guiding principle.

So you might think the Letter is about Purpose, the newly identified North Star of a company. But it is not. No sooner has Larry introduced the idea of Purpose, does he switch to the relationship between a company and its employees.

“Workers demanding more from their employers is an essential feature of effective capitalism. It drives prosperity and creates a more competitive landscape for talent, pushing companies to create better, more innovative environments for their employees – actions that will help them achieve greater profits for their shareholders.”

Larry then moves on to the theme of his 2020 letter – decarbonising the economy:

“The next 1,000 unicorns won’t be search engines or social media companies, they’ll be sustainable, scalable innovators – startups that help the world decarbonize and make the energy transition affordable for all consumers.”

Happily, too, BlackRock understand that “there’s much to learn about how a company’s relationships with stakeholders impact long-term value”, so they have launched a Center for Stakeholder Capitalism to explore the relationship between stakeholder engagement and shareholder value.

In our humble opinion, the connecting rods between stakeholder engagement and shareholder value are implicit in Larry’s Letter, though not called out as such.

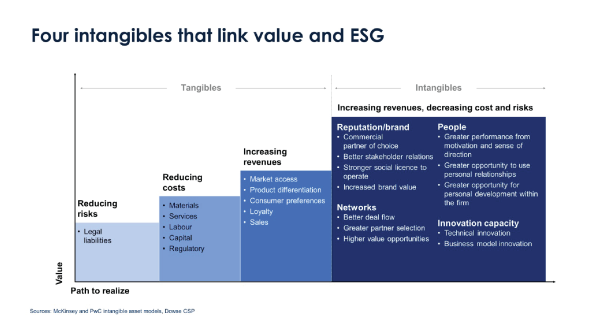

The four themes we’ve highlighted above – brand, people, relationships and innovation capacity – are the four sets of intangible assets that create value, seemingly out of thin air.

They are the intangibles that now make up, on average, at least 90% of the value of listed companies. In analysing a company, they are what investors are looking for, because they are what will reduce risks, reduce costs and increase revenues in the future, no matter what levels they have been in the past.

From there, it is not a stretch to imagine how strong ESG performance can enhance those four intangibles.

At its core, ESG is about engaging with stakeholders on the issues that matter to them most, and finding the common ground between those issues, your business and how you conduct your business.

That’s why Larry and others call it stakeholder capitalism.

“I believe in capitalism’s ability to help individuals achieve better futures, to drive innovation, to build resilient economies, and to solve some of our most intractable challenges. Capital markets have allowed companies and countries to flourish.

“But access to capital is not a right. It is a privilege. And the duty to attract that capital in a responsible and sustainable way lies with you.”

Funnily enough, just as the world is awash with money, the right to access it has got a little bit harder.

It seems that billionaires have children too, and want to be able to look them in the eye.